XRP, the native token of Ripple Labs, is continuously gaining attention from crypto enthusiasts and seems poised for a significant rally. Today, on January 7, 2024, a prominent crypto expert made a post on X (formerly Twitter) and made a bold prediction for XRP.

Expert Says Buy Signal for XRP

In a post, the expert noted that the last time a technical indicator named Supertrend flipped to bullish on the 12-hour time frame, XRP skyrocketed by 470%. Now, the altcoin has once again flipped bullish and flashing buy signal. This post on X is gaining widespread attention from crypto enthusiasts across the globe, as they are expecting a similar kind of rally this time as well.

However, this indicator flipped during a period when XRP seemed steady and appeared to be struggling to gain momentum.

At press time, XRP is trading near $2.41 and has experienced a modest price surge of 0.81% in the past 24 hours. During the same period, its trading volume jumped 10%, indicating a rise in participation from traders and investors compared to the previous day.

XRP Price Action and Key Levels

According to expert technical analysis, XRP has been consolidating in a tight range between $2.37 and $2.46 for the last five days, following the breakout of a bullish pennant pattern on the daily time frame.

Based on the recent price action, if XRP breaches this consolidation and closes a daily candle above the $2.48 mark, there is a strong possibility it could soar by 85% to reach the $4.54 level in the future.

Investors and Traders Rising Interest

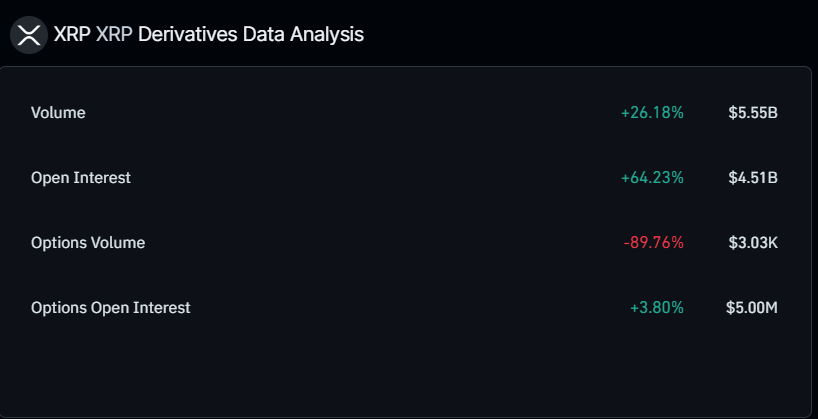

As of now, traders and long-term holders seem more interested in the altcoin, as reported by the on-chain analytics firm Coinglass.

Data from spot inflow/outflow revealed that during the same consolidation period, exchanges witnessed an outflow of a significant $38.02 million worth of XRP. This indicates that long-term holders continue to accumulate the altcoin despite the consolidation.

However, outflow refers to the movement of assets from exchanges to long-term holders’ wallets, indicating potential buying opportunities and upside momentum.

Credit: Source link