The overall cryptocurrency market sentiment appears to have shifted to an uptrend. Amid this, the popular Solana-based meme coin Dogwifhat (WIF) is poised for a significant upside rally as it is on the verge of a mega breakout.

Dogwifhat (WIF) Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, WIF, with its impressive price surge reached near its crucial resistance level of $2.95 level. However, this is the third time WIF has reached this level since June 2024. Previously, the meme coin experienced a notable price decline of over 50% after hitting this level.

However, this time, sentiment is different as we come near to the presidential election and overall cryptocurrencies are experiencing a notable price surge. If WIF breaks this resistance level and closes a daily candle above the $2.95 level, there is a strong possibility it could soar by 30% to reach the $4 level in the coming days.

In a four-hour time frame, WIF has already breached this level, but on a daily time frame, it is struggling to close its daily candle above it. Additionally, the meme coin is in an uptrend, as it is trading above the 200-day Exponential Moving Average (EMA).

WIF’s Bullish On-Chain Metrics

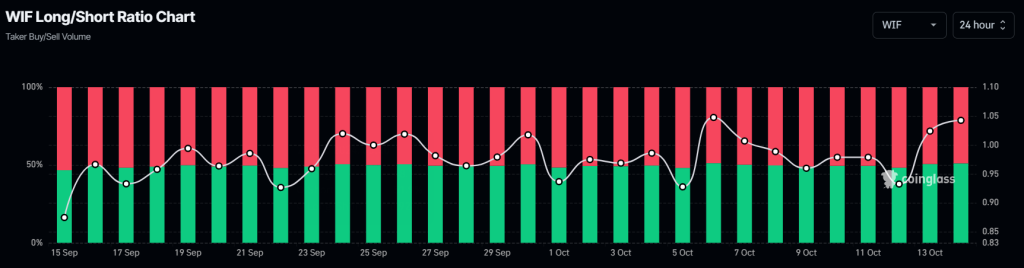

WIF’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, WIF’s Long/Short ratio currently stands at 1.03, indicating strong bullish sentiment among traders.

Additionally, its future open interest has skyrocketed by 15% over the past 24 hours and 5.5% over the past four hours. This rising open interest suggests growing traders’ interest in the WIF as it approaches the resistance level.

Combining these bullish on-chain metrics with the technical analysis, it appears that currently bulls are dominating the asset and may help traders and investors breach that level.

Current Price Momentum

As of writing, WIF is trading near $2.86 and has experienced a price surge of over 9.5% in the past 24 hours. During the same period, its trading volume jumped by 45%, indicating higher participation from traders compared to the previous day, potentially driven by the bullish outlook.

Credit: Source link