Solana (SOL), the world’s fifth-biggest cryptocurrency by market cap is poised for a massive price surge in the coming days following its major breakout. After struggling for nearly two weeks near the strong resistance level of $138, SOL has broken through this level today with a strong bullish candle on the daily time frame.

Solana (SOL) Price Prediction For September 14

According to the expert technical analysis, SOL appears bullish despite trading below the 200 Exponential Moving Average (EMA) on a daily time frame. In trading or investing, the 200 EMA is a technical indicator that suggests whether an asset is in an uptrend or downtrend.

Based on the historical price momentum, if SOL closes a daily candle above the $138 level, there is a strong possibility that it could soar by 20% to the $163 level and further to the $185 level if the bullish sentiment continues.

SOL’s Bullish On-chain Metrics

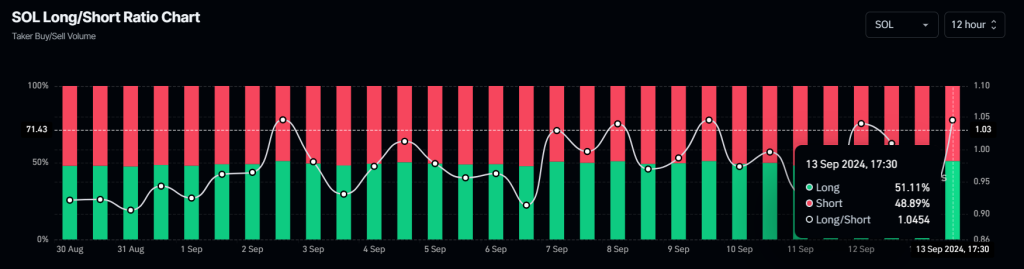

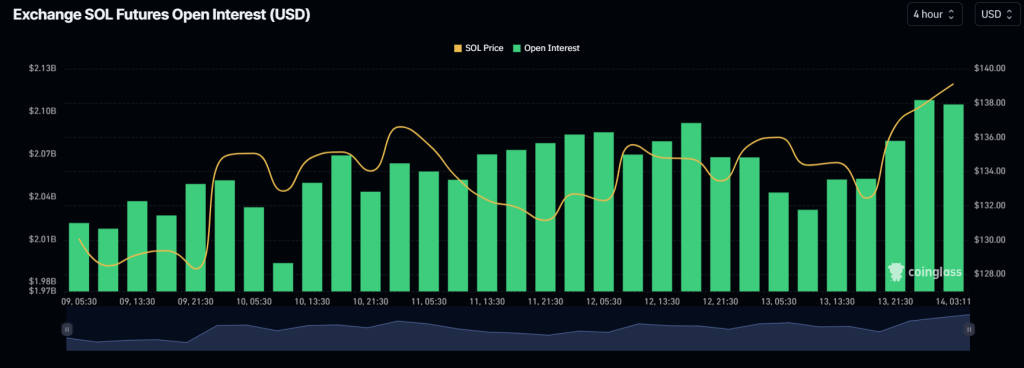

SOL’s bullish outlook is further supported by on-chain metrics such as long/short ratio, future open interest, and OI-weighted funding rate.

Coinglass’s long/short ratio for SOL currently stands at 1.0454, indicating traders’ bullish market sentiment. This on-chain metric helps traders and investors to identify the market sentiment. At press time, 51.11% of top traders hold long positions in SOL, while 48.89% hold short positions.

Meanwhile, SOL’s future open interest has increased by 4.5% in the last 24 hours and has been steadily rising. This indicates that traders are betting more on long positions rather than short positions. Traders and investors often consider rising open interest and a long/short ratio above 1, while building long or short positions.

Additionally, SOL’s OI-weighted funding rate currently stands at +0.0024%, indicating a bullish outlook for Solana.

Current Price Momentum

At press time, SOL is trading near $139 and has experienced and has experienced a price surge of over 2.75% in the last 24 hours. Meanwhile, its trading volume has by 2.5% during the same period. This rising trading volume suggests higher participation from traders and investors following the recent breakout of a crucial resistance level.

This bullish thesis will only hold if SOL closes its daily candle above the resistance level, otherwise, it may fail.

Credit: Source link