Solana Latest Update: Amidst the market recovery, a crypto wallet linked to bankrupt FTX/Alameda withdrew a significant 177,693 SOL, worth $23.75 million from Solana PoS, according to SolScan. Traders and investors should keep an eye on this substantial fund, as its movement to centralized exchanges (CEXs) could potentially create notable selling pressure.

FTX-Linked Wallet Raises Concern of Selling Pressure

As of now, Solana traders and investors are curious about the potential reason behind the unstaking. Once the tokens are unstaked, they could potentially move to the CEXs, SOL reserve on the exchanges increases resulting in significant selling pressure and negative price impact.

Besides this significant token withdrawal from staking, the wallet currently holds a massive 7.057 million SOL, worth $943 million, in Solana PoS Staking.

Current Price Momentum

At press time, SOL is trading near $135 and has experienced a price surge of over 2.85% in the last 24 hours. Additionally, this notable fund withdrawal didn’t impact the SOL price. Meanwhile, its trading volume has dropped by 30% during the same period, indicating lower participation from traders, potentially due to the recent transaction by the FTX-linked wallet.

Solana Technical Analysis and Upcoming Levels

According to expert technical analysis, SOL is currently facing a strong resistance level of $138, which it has struggled with for the past two weeks. Additionally, it is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend.

Based on historical price momentum, if SOL closes a daily candle above $138, there is a high possibility it could soar by 18% to $163 or even higher, potentially reaching $185. This bullish thesis will only hold if SOL closes a daily candle above $138, otherwise, it may fail.

Bullish On-chain Metrics

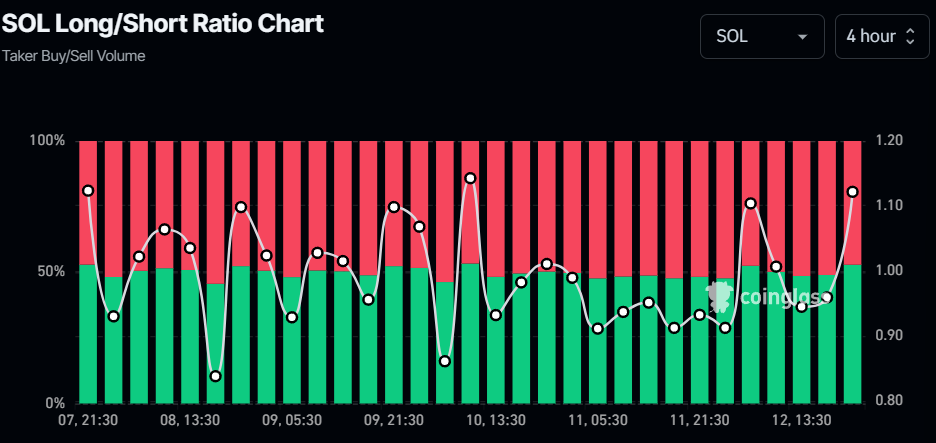

However, this bullish outlook is further supported by on-chain metrics. Coinglass’s SOL Long/Short ratio currently stands at 1.121, indicating bullish market sentiment. Additionally, 52.86% of top Solana traders hold long positions, while 47.14% hold short positions.

Meanwhile, SOL’s Future open interest has remained unchanged in the last 24 hours but has been falling since the beginning of September 2024.

Credit: Source link