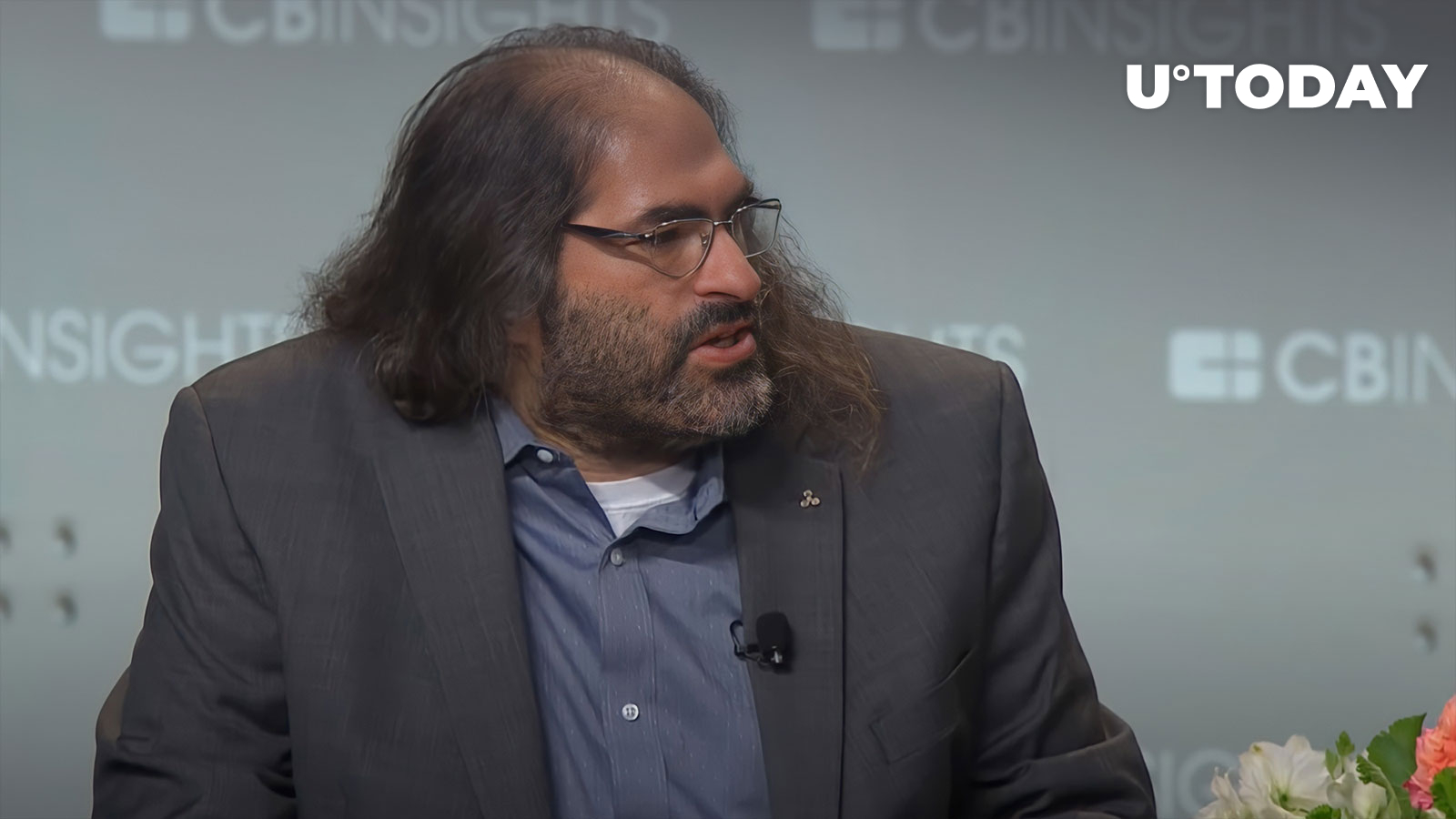

Ripple CTO David Schwartz has criticized the US Securities and Exchange Commission (SEC) for its lack of clear guidelines on cryptocurrency regulation following Coinbase’s recent Wells notice

Read U.TODAY on

Google News

Ripple CTO David Schwartz has once again weighed in on Coinbase’s recent Wells notice from the US Securities and Exchange Commission (SEC).

The architect behind the XRP Ledger took to Twitter to criticize the SEC for failing to provide clear guidelines on cryptocurrency regulation.

A Wells notice is a formal notification that gives the recipient an opportunity to respond to the allegations before the regulatory agency decides to pursue the case in court.

Schwarz’s comments came in response to Coinbase’s chief legal officer Paul Grewal stating that the SEC needs to provide reasonable rules for crypto in the US, and that Coinbase is willing to follow them. He also said that the SEC has not been fair or reasonable in their engagement on digital assets, and that rulemaking and legislation are better tools for defining the law for the industry than enforcement actions. Coinbase is confident in the legality of their assets and services and is open to a legal process to provide clarity.

Coinbase has met with the SEC more than 30 times over nine months, but they were doing all of the talking. Coinbase’s staking and exchange services are largely unchanged since 2021, and their core business model remains the same.

Coinbase’s stance is that the U.S. crypto regulatory environment needs more guidance, not more enforcement.

The company has also stated that their staking services are not securities under any legal standard, including the Howey test.

Schwartz also addressed the question of why Ripple had not sought a no-action letter from the regulator before moving forward with launching XRP.

In response, he tweeted that he was not part of the process. At the same time, he suggested that the fact that no other crypto company had received a productive outcome from this process made it seem unlikely that his company would have benefited from it.

Credit: Source link