Amid the ongoing price correction across the cryptocurrency market, Elon Musk’s Tesla has just moved a substantial amount of Bitcoin (BTC) to an unknown wallet. On October 16, 2024, the on-chain intelligence firm Arkham made a post on X (Previously Twitter) that the giant electric car manufacturer, Tesla had just moved 11,500 BTC worth $760 million.

Is Tesla Selling its BTC Holdings?

This significant BTC transfer has raised concerns about whether Tesla is selling its BTC holdings or what they plans to do next. However, this is the first time in the past two years that Tesla has moved its BTC holdings. According to the data, Tesla is the fourth-largest BTC holder following MicroStrategy, mining firm Marathon Digital, and Riot Platform.

Following this significant BTC transaction, Tesla hasn’t published any comments. However, despite this notable BTC transfer, asset prices remained stable and no major changes were witnessed on the exchanges nor was there any dumping from major whales.

BTC Current Price Momentum

At press time, BTC is trading near $66,880 and has experienced a modest price surge of over 1.35% in the past 24 hours. During the same period, its trading volume has increased by 20%, indicating higher participation from traders and investors.

Bitcoin Technical Analysis, Will Price Drop?

According to expert technical analysis, BTC is currently facing strong resistance at the upper boundary of a descending channel pattern. This is the sixth time the world’s largest cryptocurrency has reached this level since March 2024.

Historical data shows that whenever BTC reaches this level, it experiences notable selling pressure and a price decline of over 20%.

However, this time sentiment is quite different as we approach the presidential election in the United States. Data shows that in the last two elections, the crypto market experienced a notable rally in October ahead of the elections.

BTC’s Bearish On-Chain Metrics

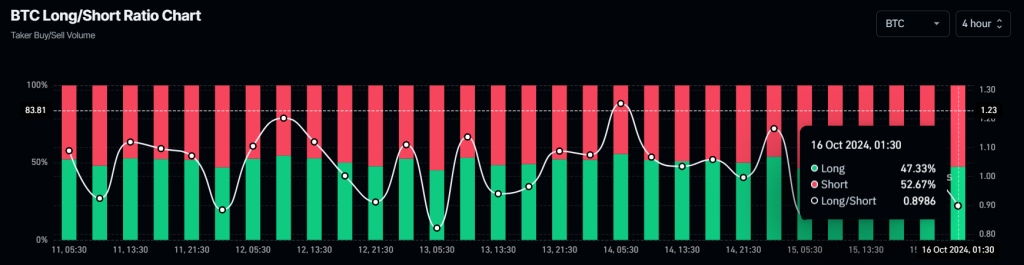

Additionally, the on-chain analytics firm Coinglass indicates weak market sentiment among traders over the past four hours. According to the data, BTC’s long/short ratio currently stands at 0.89, reflecting bearish sentiment.

Currently, 52.7% of top traders hold short positions, while 47.3% hold long positions.

Credit: Source link