The Bitcoin MVRV Z-Score has historically been one of the most effective tools for identifying market cycle tops and bottoms in Bitcoin. Today, we’re excited to share an enhancement to this metric that makes it even more insightful for today’s dynamic market conditions.

What Is the Bitcoin MVRV Z-Score?

The MVRV Z-Score is derived by analyzing the ratio between Bitcoin’s realized cap (the average acquisition cost of all Bitcoin in circulation) and its market cap (current network valuation). By standardizing this ratio using Bitcoin’s price volatility (measured as the standard deviation), the Z-Score highlights periods of overvaluation or undervaluation relative to historical norms.

View Live Chart 🔍

Peaks in the red zone signal overvaluation, suggesting optimal profit-taking opportunities. Bottoms in the green zone indicate undervaluation, often marking strong accumulation opportunities. Historically, this metric has been remarkably accurate in pinpointing major market cycle extremes.

While powerful, the traditional MVRV Z-Score has its limitations. In past cycles, the Z-Score reached values of 9–10 during market tops. However, in the last cycle, the score only reached around 7. This may be due to the rounded double-peak cycle instead of the sharp blow-off top we usually experience. Regardless, there’s the necessity to factor in the evolving market dynamics, with increasing institutional involvement and changing investor behavior.

The Enhanced MVRV Z-Score

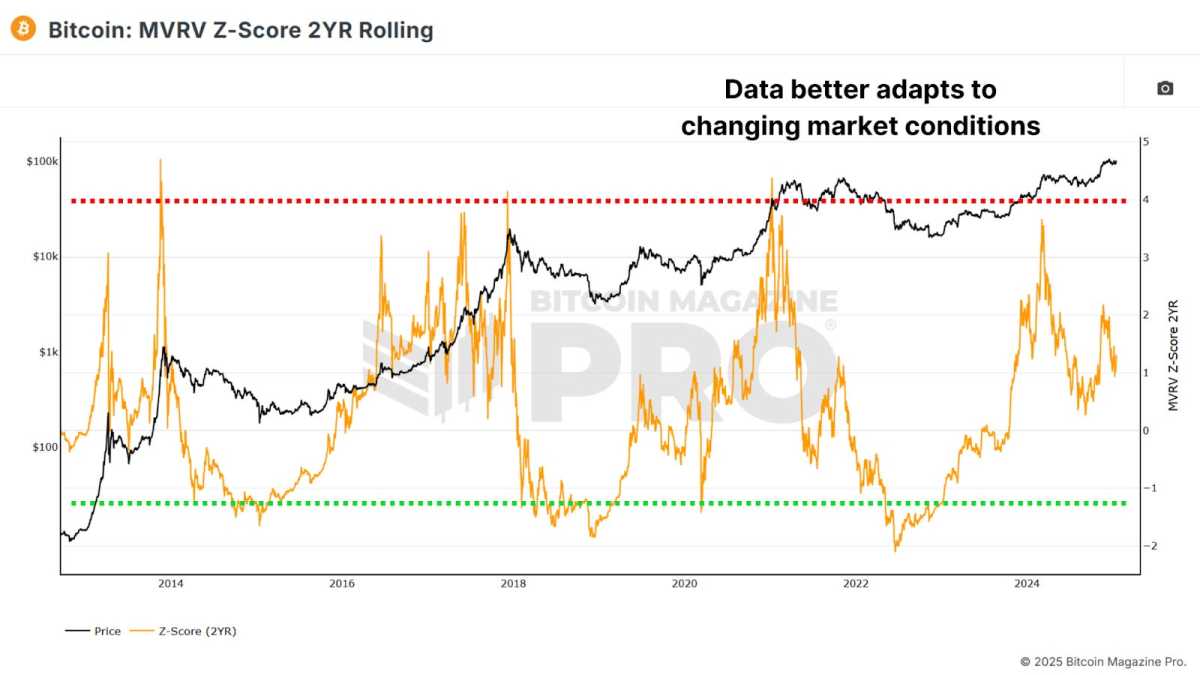

The MVRV Z-Score standardizes the raw MVRV data using Bitcoin’s entire price history, which includes the extreme volatility of its early years. As Bitcoin matures, these early data points may distort its relevance to current market conditions. To address these challenges, we’ve developed the MVRV Z-Score 2YR Rolling. Instead of using Bitcoin’s entire price history, this version calculates volatility based only on the previous two years of data.

View Live Chart 🔍

This approach better accounts for Bitcoin’s growing market cap and shifting dynamics and ensures the metric adapts to more recent trends, offering greater accuracy for contemporary market analysis. It still excels at identifying market cycle tops and bottoms but adapts to modern conditions. In the last cycle, this version captured a higher peak value than the traditional Z-Score, aligning more closely with 2017’s price action. On the downside, it continues to identify strong accumulation zones with high precision.

Raw MVRV Ratio

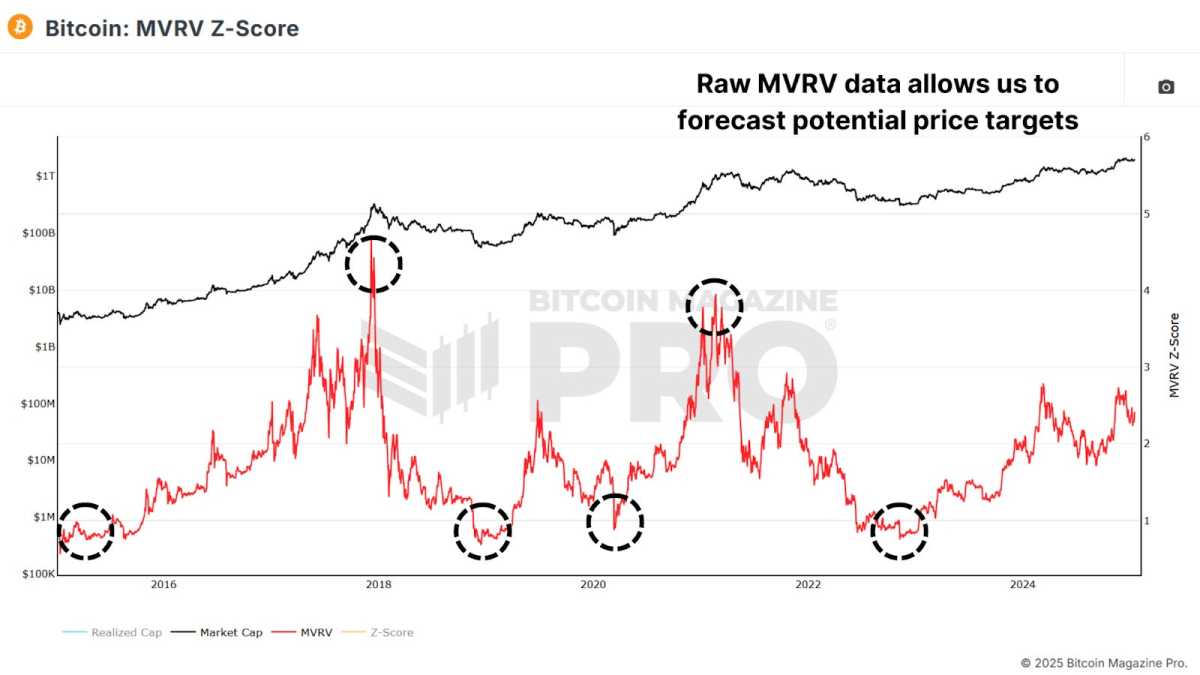

Another complementary approach involves analyzing the MVRV ratio without standardizing for volatility. By doing so, we can see the previous cycle’s MVRV ratio peaked at 3.96, compared to 4.72 in the cycle before that. These values suggest less deviation, potentially offering a more stable framework for projecting future price targets.

View Live Chart 🔍

Assuming a realized price of $60,000 (factoring in the current projected increase over the next six months) and an MVRV ratio of 3.96, a potential peak price could be close to $240,000. If diminishing returns reduce the ratio to 3.0, the peak price might still reach $180,000.

Conclusion

While the MVRV Z-Score is still one of the most effective tools for timing market cycle peaks and bottoms, we need to be prepared for this metric potentially not reaching similar highs as prior cycles. By adapting this data to better factor in the changing market dynamics of Bitcoin, we can account for reduced volatility as BTC grows.

For a more in-depth look into this topic, check out a recent YouTube video here:

Improving The Bitcoin MVRV Z-Score

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Credit: Source link