This month, the crypto world was shaken by a new crime drama involving Bitcoin Automated Teller Machines (ATMs). The execs of one of the biggest crypto ATM operators were arrested and charged, bringing back concerns about how crypto tellers are used.

Fourth-Biggest Bitcoin ATM Operator Under Investigation

Bitcoin of America, the fourth biggest Bitcoin ATM operator in the United States, might be at risk of shutting down businesses after the arrest of its executive team on March 2.

The company’s CEO and founder, Sonny Meraban, was arrested during the complex operation led by 30 law enforcement agencies, including the United States Secret Service and FBI. Investigators seized 52 crypto ATMs, or kiosks, in three areas around Cleveland.

Sonny Meraban has been indicted on 58 charges of money laundering, illegal operations, conspiracy, engaging in a pattern of corrupt activity, and other offenses.

The other two detainees also face identical charges. One of them, Reza Mehraban, is the father and manager of the company’s CEO. The other is the company’s attorney, William Suriano.

According to investigators, Bitcoin ATMs were used by malicious actors who converted cash into Bitcoins, while Bitcoin of America charged 20% fees per transaction. The total collected is said to be around $3.5 million.

According to Coin ATM Radar, Bitcoin of America has 2,576 crypto ATM locations in 31 states nationwide. This is a 6.8% share of the US crypto ATM market.

Source: CoinATMRadar

“We have become one of the most trusted names in the bitcoin atm industry,” says the official website.

The company saw tremendous growth in 2021, the year of the massive crypto bull rally, when it nearly doubled the number of its Bitcoin ATMs within eight months.

Over 20,000 new crypto ATMs were installed that year, with well-known companies like Walmart and Circle K hosting them in their stores.

Soaring Crypto ATM Business Slows Down

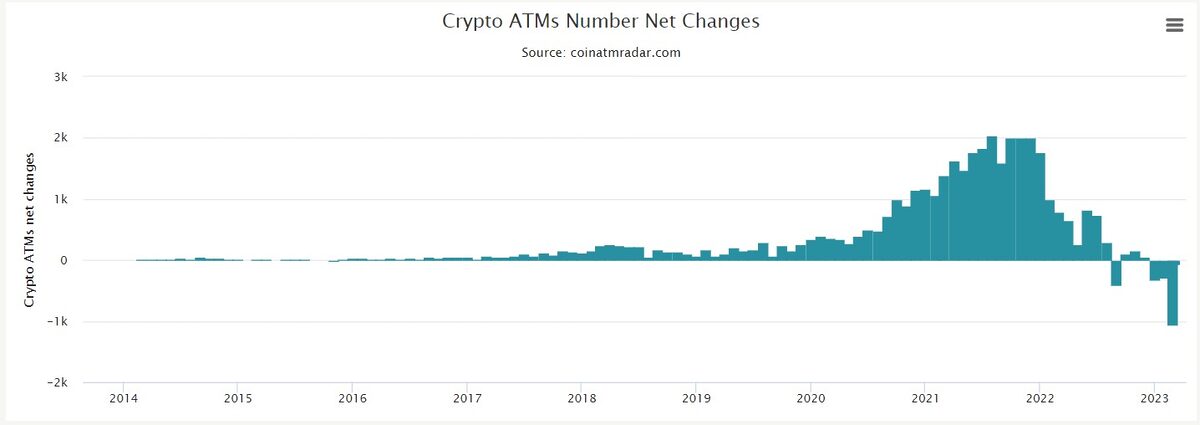

The US crypto ATM market has been in a slowdown since the first month of 2022 when Bitcoin’s price continued to slide down from the $69K all-time high reached in November 2021.

Consequently, the number of operating crypto ATMs has gradually decreased since last January. In March 2023, the industry reached new lows, with 1,055 removed cryptocurrency ATMs on record. The number marks an all-time low for the US crypto ATM industry, according to the data from Coin ATM Radar.

Source: CoinAtmRadar

Multiple factors, including geopolitical tensions and crypto winter, affected the industry. Crypto ATM operators like Bitcoin Depot converted their crypto kiosks into ATM software to reduce operational costs.

Despite the decline, more than 38,000 Bitcoin ATMs are left worldwide. More than 86% are in the United States, followed by Canada.

How Bitcoin ATM Operators Make Money

Like any automated teller machine, crypto ATMs accept and withdraw cash. However, Bitcoin kiosks do not send money to a bank account. Instead, they convert deposited funds to Bitcoin or any other available crypto and transfer them to the owner’s digital wallet.

All crypto ATMs charge a certain percentage of the transaction fee from the transfer amount. The amount, typically between 7% and 20%, is the profit that goes to the ATM operator.

Bitcoin ATMs Exploited for Illicit Activities

Crypto ATMs offer anonymous transactions. Most crypto tellers do not require photo identification and address for transactions under $1,000. A phone number is enough. This means anyone with a phone can instantly and anonymously convert cash into crypto.

Besides, one crypto ATM operator does not know who converted cash to Bitcoin via its competitor. Transfers do not require third-party verification. Thus, the lack of information sharing makes it possible to deposit multiple daily limits on ATMs of different operators.

While topping up a Bitcoin wallet with cash seems an innocent and convenient way to store value, a large number of such transfers end up in dark web marketplaces, offshore exchanges, or coin mixers, where funds can be later moved to illicitly finance terrorist organizations, oligarchs, drug lords, and human traffickers.

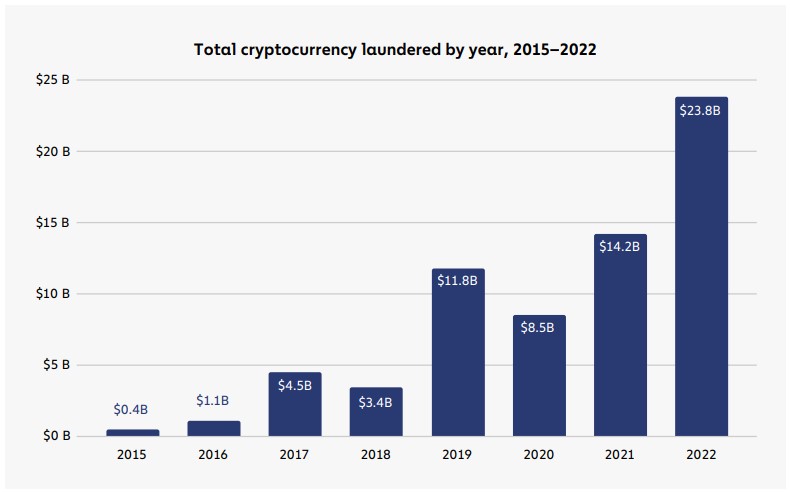

Around $67.5 million of funds were transferred to wallets associated with illicit activity last year, says blockchain analysis firm Chainalysis in its 2023 Crypto Crime Report. Around 75% of illegal funds that moved through crypto ATMs ended up at darknet marketplaces.

In total, criminals laundered $23.8 billion in digital assets during 2022, according to Chainalysis’s 2023 report. This is 67% more than the previous year’s $14.2 billion.

Source: Chainalysis

Criminals also use crypto ATMs as tools to extract funds from defrauded investment scam victims.

The criminals apply a simple fraudulent scheme. They pretend to be a legit tax collector or an agent from a utility company and ask the victim to make payments to their accounts via Bitcoin ATMs.

As the FBI warned, similar crypto ATM exploits became highly popular among so-called pig butchering scammers. It is a growing form of romance scam where victims are manipulated into transferring funds to fake investment platforms.

"Regardless of the scheme, the methods using cryptocurrency ATMs and QR codes appear similar," the FBI says. "The scammers provide a QR code associated with the scammer's cryptocurrency wallet for the victim to use during the transaction."

When the victim makes the payment, the recipient immediately owns the cryptocurrency. They often make further instant transactions and transfer funds to overseas accounts.

Contrary to traditional fiat ATMs, transactions via crypto ATMs do not remain pending for hours or days before settlement. This makes fund recovery almost impossible and almost always leaves victims with losses.

In December 2022, two US Senators introduced the Digital Asset Anti-Money Laundering Act of 2022, which obliges FinCEN to ensure that digital asset ATM owners and administrators submit and regularly update the physical addresses of crypto kiosks and verify customer identity.

Final Thoughts

In the United States and Europe, companies wishing to operate crypto ATMs must be registered with the local financial authority as a cryptocurrency company that complies with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

However, just a year ago, all crypto ATM operators in the UK were functioning without proper licenses or, simply speaking, illegally.

By providing quick and easy access to cryptocurrencies, Bitcoin kiosks are vulnerable to regulatory breaches and risk being used for illicit activities like money laundering or terrorist financing.

Find out more on:

Crypto ATMs: How Do They Work and How Are They Different from Fiat ATMs?

What Ties Donald Trump to Crypto Besides NFTs?

Credit: Source link