Ethereum price has retreated sharply in the past few days after finding substantial resistance at $4,000.

Ethereum (ETH) traded at $3,340 on Monday as cryptocurrencies stabilized. This was slightly up from last week’s low of $3,100.

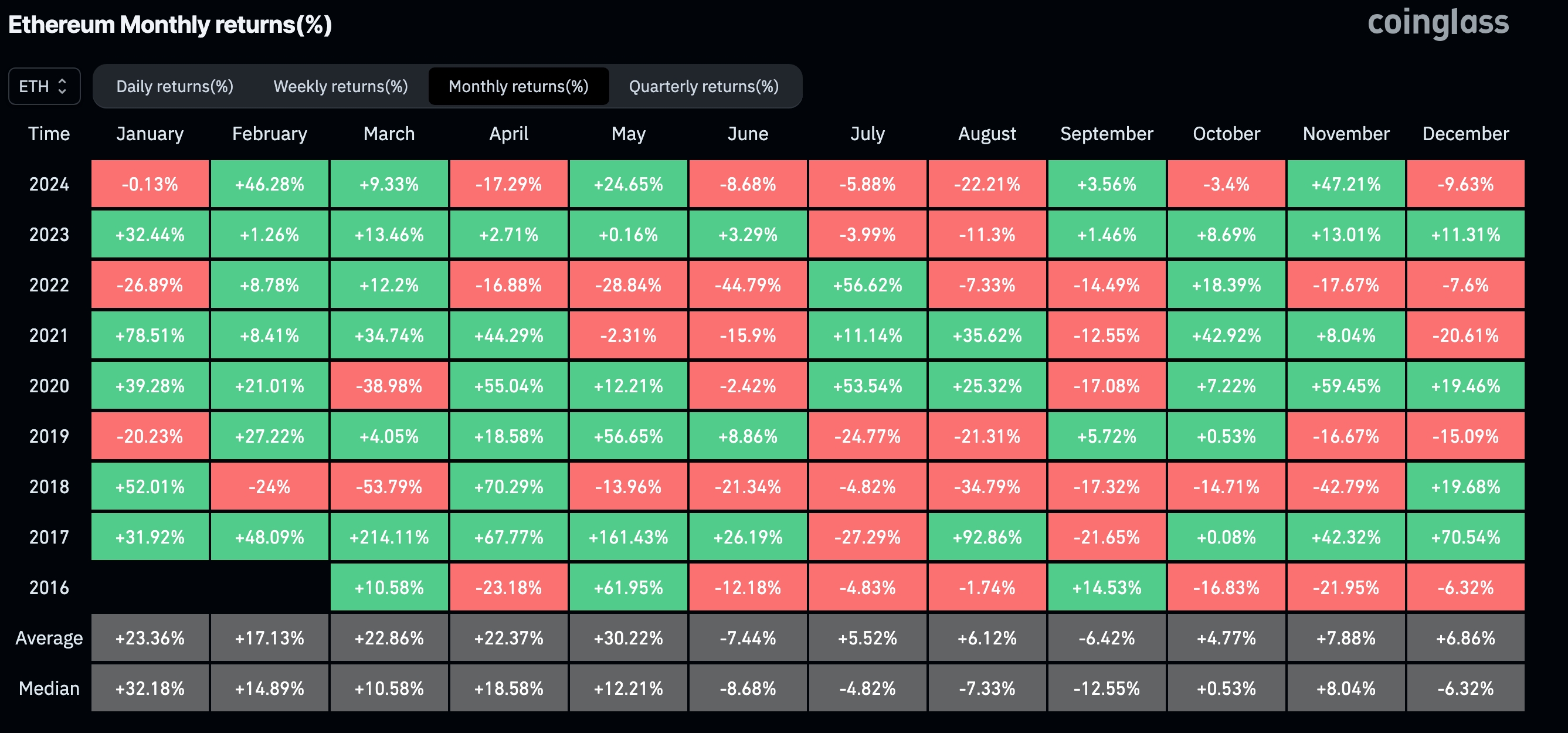

Seasonality data suggests that Ethereum price may rebound sharply in the first quarter of 2025. According to CoinGlass, ETH had positive returns in all but two first quarters since 2017. Its best performance was in 2017, when it jumped by 518%, followed by 202,1 when it rose by 160%.

Its average first-quarter returns since 2017 were 92%, making it the best period of the year. The second quarter is its best quarter, followed by Q4. The third quarter is usually the worst period for cryptocurrencies, likely because of the summer season.

More data shows that Ethereum rises in the first four months after a US election. Its average returns in the first four months of Donald Trump’s administration was about 90%. Similarly, in 2021, its four-month return after Biden became president was $41.

To be clear, seasonality data is not always a good predictor of what to expect. In its case, Ethereum dropped in January 2024, 2022, and 2019, and this one may be one of them.

On the positive side, Ethereum price has some strong fundamentals. Spot ETH ETFs are seeing strong accumulations by investors, with their cumulative inflows rising to over $2.33 billion.

Ethereum’s network has made over $2.44 billion in fees this year, making it the second-most profitable network after Tether. The network remains dominant in the decentralized finance industry, with a total value of $66 billion, higher than most ten chains combined.

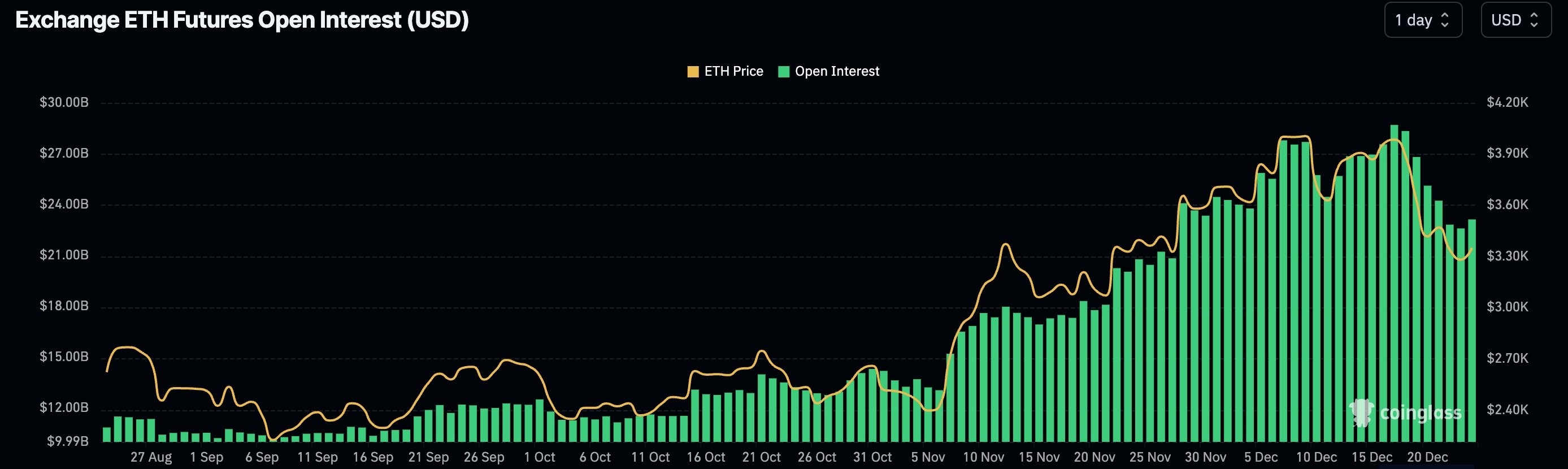

The other potential catalyst for Ethereum price is that its futures open interest has dropped to $23 billion from the year-to-date high of $28 billion. The last time its open interest was this low was in November, and the coin bounced back to $4,000.

Ethereum price technical analysis

The weekly chart shows that Ether has strong technicals as it has remained above the ascending trendline that connects the lowest swings since May 2022. It has also moved slightly above the 50-week moving average and the first support of Andrew’s pitchfork tool.

Therefore, Ethereum price will likely bounce back in the next few months. A complete bullish breakout will be confirmed if the coin rises above the triple-top chart pattern at $4,027. A move above that level will point to more gains to the all-time high of $4,860, its all-time high.

Credit: Source link