XRP ETF approval discussions have intensified as NYSE Arca files are to convert Grayscale’s XRP Trust into a spot ETF. This could be the start for a potential watershed moment for cryptocurrency investment. This development arrives alongside a remarkable XRP liquidity surge through the RLUSD/XRP AMM pool, which accumulated an amazing $423,000 in total value locked within hours from the activation. This shows the growing market confidence taking place within the current crypto market volatility.

The AMMClawback amendment is now live on the mainnet: https://t.co/GUKD32LdL9 https://t.co/57738PlM98 pic.twitter.com/HKrUhJb2MP

— XRPScan (@xrpscan) January 30, 2025

Also Read: Dogecoin Weekend Price Prediction: DOGE Eyes $0.36 In A Fresh New Ascent

Unpacking XRP’s ETF Move and $423K AMM Pool Growth Amid Market Volatility

NYSE Arca’s Bold Move for XRP Trust Conversion

Woohoo!! https://t.co/2MWqrotXtQ

— David “JoelKatz” Schwartz (@JoelKatz) January 30, 2025

The XRP ETF approval is really heating up these last few days. They’ve pulled in some serious players to run the show. They got Coinbase Custody Trust Company keeping an eye on everyone’s money, while BNY Mellon Asset Servicing’s pushing all the paperwork around. I just pulled up the latest stats, and wouldn’t you know it – the XRP Trust is rocking a cool $16.1 million in assets right now. No small potatoes, especially when you look at how smoothly they knocked out those other trust conversions one by one. Talk about a winning streak!

David Schwartz, Ripple CTO, had this to say on X:

“Woohoo!!”

RLUSD/XRP AMM Pool Launch Success

XRP / RLUSD AMM Pool is created on the XRP Ledger DEX!

🔹 In total 4 AMM Pools with RLUSD pair pic.twitter.com/Qrq0SU23Ap

— Vet (@Vet_X0) January 30, 2025

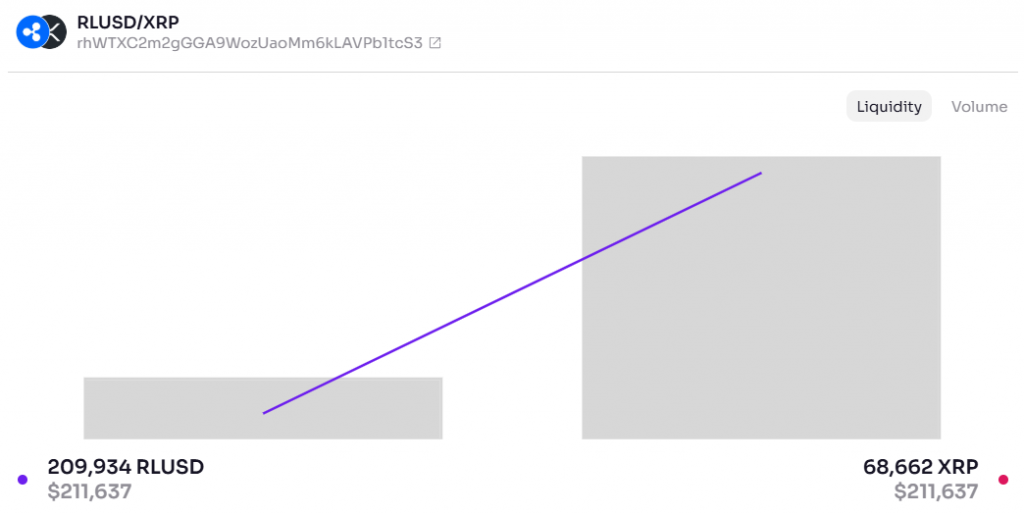

There are multiple signs of an XRP liquidity surge that emerged after the AMMClawback amendment went live. Various trading pairs showed some strong activity, with the main RLUSD/XRP pool splitting a value of about $423,000 between 68,662 XRP and 209,934 RLUSD.

Also Read: De-Dollarization: Trump Threatens 100% Tariffs on Nations Ditching the US Dollar

Market Impact and XRP ETF Prospects

Some institutional players keep showing interest despite crypto market volatility. A few major asset managers, including Rex Shares and Canary Capital, have jumped into the XRP ETF approval race. XRP is trading near a value of $3.13 at this time, and it is approaching its peak value of $3.40. Some believe that XRP might reach it soon.

RLUSD’s Role in Enhancing XRP Liquidity

Jack McDonald, Standard Custody CEO, had this to say:

“RLUSD is over-reserved (as in our reserves are more than 100% of the total supply) – backed by US dollar deposits, short-term U.S. government securities and other cash equivalents. We currently hold ~$6M more in reserves than the total RLUSD supply.”

Several market indicators show growing confidence, with the stablecoin reaching close to $100 million in market cap since launch, adding to the overall XRP liquidity surge.

A little over a month since $RLUSD’s launch, we’ve seen amazing traction hitting ~$100M in market cap. As previously committed, we’ll be publishing a monthly independent attestation for RLUSD, in compliance with the highest regulatory standards.

A few points to keep in mind:…

— Jack McDonald (@_JackMcDonald_) January 30, 2025

Also Read: IBM Stock Surges 12% After Q4 2024 Earnings Beat Expectations

Credit: Source link