The recent divergence in U.S. Treasury yields, where shorter-term yields have been declining while longer-term yields are on the rise, has sparked significant interest across financial markets. This development provides critical insights into macroeconomic conditions and potential strategies for Bitcoin investors navigating these uncertain times.

We’ve recently observed a divergence in U.S. Treasury yields, with shorter-term yields declining while longer-term yields are rising. 🏦

What do you think this signals for the government bond market, Bitcoin, and the broader financial markets? 🤓

Let me know 👇 pic.twitter.com/eJmj6hhyKV

— Bitcoin Magazine Pro (@BitcoinMagPro) January 27, 2025

Treasury Yield Dynamics

Treasury yields reflect the return investors demand to hold U.S. government debt, and they are a critical barometer for the economy and monetary policy expectations. Here’s a snapshot of what’s happening:

- Short-term yields falling: Declining yields on short-term Treasury bonds, such as the 6-month yield, suggest that markets are anticipating the Federal Reserve will pivot to rate cuts in response to economic slowdown risks or lower inflation expectations.

- Long-term yields rising: Meanwhile, rising yields on longer-term bonds, like the 10-year Treasury yield, indicate growing concerns about persistent inflation, fiscal deficits, or higher-term premiums required by investors for holding long-duration debt.

This divergence in yields often hints at a shifting economic landscape and can serve as a signal for investors to recalibrate their portfolios.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

Why Treasury Yields Matter for Bitcoin Investors

Bitcoin’s unique properties as a non-sovereign, decentralized asset make it particularly sensitive to macroeconomic trends. The current yield environment could shape Bitcoin’s narrative and performance in several ways:

- Inflation Hedge Appeal:

- Rising long-term yields may reflect persistent inflation concerns. Historically, Bitcoin has been seen as a hedge against inflation and currency debasement, potentially increasing its appeal to investors looking to protect their wealth.

- Risk-On Sentiment:

- Declining short-term yields could indicate looser financial conditions ahead. Easier monetary policy often fosters a risk-on environment, benefiting assets like Bitcoin as investors seek higher returns.

- Financial Instability Hedge:

- Divergence in yields, particularly if it leads to an inverted yield curve, can signal economic instability or recession risks. During such periods, Bitcoin’s narrative as a safe-haven asset and alternative to traditional finance may gain traction.

- Liquidity Considerations:

- Lower short-term yields reduce borrowing costs, potentially leading to increased liquidity in the financial system. This liquidity often spills into risk assets, including Bitcoin, fueling upward price momentum.

Broader Market Insights

The impact of yield divergence extends beyond Bitcoin to other areas of the financial ecosystem:

- Stock Market: Lower short-term yields typically boost equities by reducing borrowing costs and supporting valuation multiples. However, rising long-term yields can pressure growth stocks, particularly those sensitive to higher discount rates.

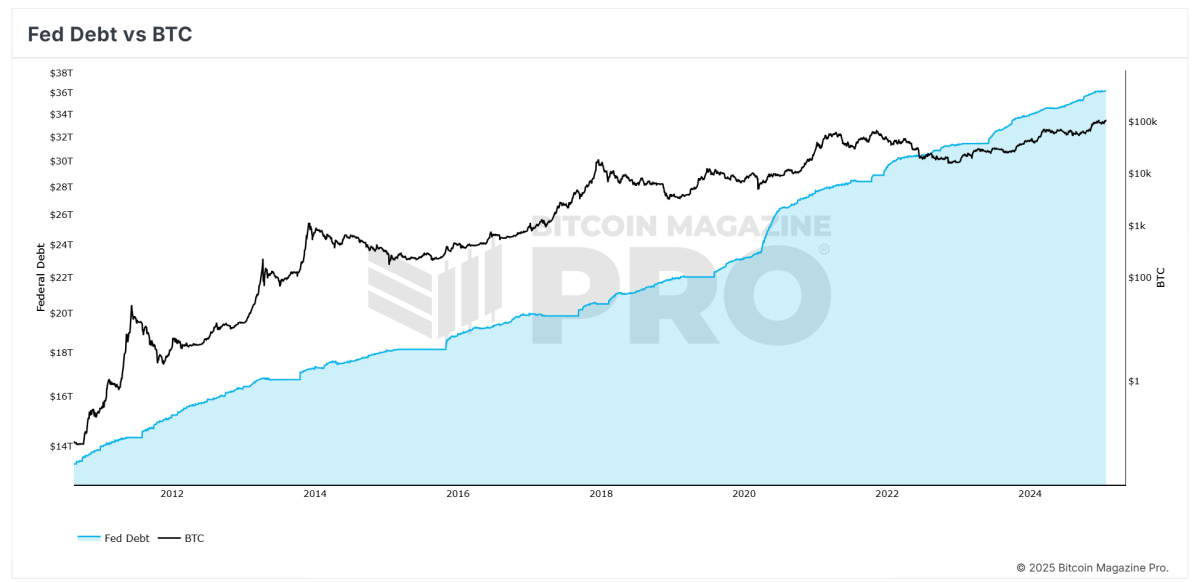

- Debt Sustainability: Higher long-term yields increase the cost of financing for governments and corporations, potentially straining heavily indebted entities and creating ripple effects across global markets.

- Economic Outlook: The divergence could reflect market expectations of slower near-term growth coupled with longer-term inflationary pressures, signaling potential stagflation risks.

Related: What Bitcoin Price History Predicts for February 2025

Takeaways for Bitcoin Investors

For Bitcoin investors, understanding the interplay between Treasury yields and macroeconomic trends is essential for informed decision-making. Here are some key takeaways:

- Monitor Monetary Policy: Keep a close eye on Federal Reserve announcements and economic data. A dovish pivot could create tailwinds for Bitcoin, while tighter policy might pose short-term challenges.

- Diversify and Hedge: Rising long-term yields could lead to volatility across asset classes. Diversifying into Bitcoin as part of a broader portfolio strategy may help hedge against inflation and economic uncertainty.

- Leverage Bitcoin’s Narrative: In an environment of fiscal deficits and monetary easing, Bitcoin’s story as a non-inflationary store of value becomes more compelling. Educating new investors on this narrative could drive further adoption.

Conclusion

The divergence in Treasury yields underscores shifting market expectations around growth, inflation, and monetary policy—factors that have far-reaching implications for Bitcoin and broader financial markets. For investors, understanding these dynamics and positioning accordingly can unlock opportunities to capitalize on Bitcoin’s unique role in a rapidly changing economic landscape. As always, staying informed and proactive is key to navigating these complex times.

For ongoing access to live data, advanced analytics, and exclusive content, visit BitcoinMagazinePro.com.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct thorough independent research before making investment decisions.

Credit: Source link