Dogecoin (DOGE), the popular and largest crypto meme coin by market capitalization is poised for a price decline as sentiment begins to shift. For the past few days, the overall cryptocurrency market has been quite confusing, raising concerns about whether the price will rally or decline.

However, at this moment it is unpredictable for forecasting price, although the DOGE daily chart has formed a bearish price action.

Dogecoin (DOGE) Technical Analysis and Upcoming Level

According to CoinPedia’s technical analysis, DOGE is currently at a crucial support level of $0.383, after breaking out from an ascending triangle price action pattern. With the recent ups and downs, along with significant volatility, DOGE has successfully retested the breakdown level and is currently receiving support.

Based on the recent price action and historical momentum, if DOGE fails to hold this support level and closes a daily candle below the $0.38 level, there is a strong possibility it could decline by 15% to reach the $0.31 level in the coming days.

However, DOGE’s Relative Strength Index (RSI) currently stands at 50, which is far from the overbought region, indicating a potential price reversal in the coming days.

83.68% DOGE Traders Holds Long Positions

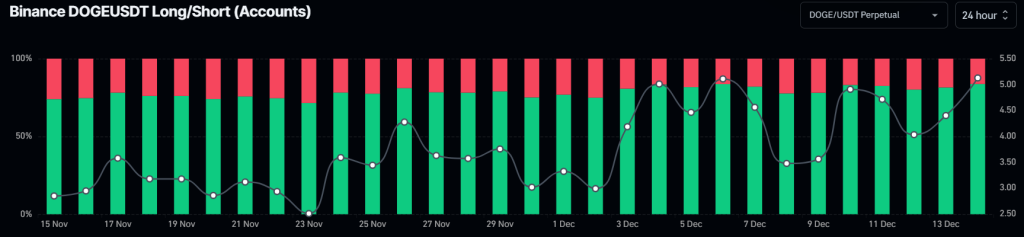

Besides the bearish technical analysis, it appears that traders are the ones keeping DOGE at the $0.383 support level, as reported by the on-chain analytics firm Coinglass. Data from the Binance DOGEUSDT Long/Short ratio currently stands at 5.13, indicating strong bullish market sentiment among traders.

Additionally, data reveals that currently, 83.68% of top Binance traders hold long positions, while 16.32% hold short positions.

When combining these on-chain metrics with the technical analysis, it appears that bulls are currently trying to keep the price above the crucial support level and prevent further price decline.

DOGE Current Price Momentum

At press time, DOGE is trading near $0.39 and has experienced a price decline of over 2.65% in the past 24 hours. During the same period, its trading volume dropped by 26%, indicating lower participation from traders and investors as sentiment turns bearish.

Credit: Source link