It appears that Crypto-focused investment firms are now eyeing the XRP Exchange Traded Fund (ETF) in the United States. Following the successful launch of Bitcoin and Ethereum ETFs, a new crypto-focused investment firm Canary Capital, filed for an XRP ETF by submitting Form S-1 to the US Securities and Exchange Commission (SEC) last week.

First to File For XRP ETF

However, this filing by Canary Capital has gained significant attention from the crypto community as it was founded by Steven Mcclurg, the former CIO and co-founder of Valkyrie Fund.

In addition to Canary Capital, the asset management giant Bitwise Investment also filed for an XRP ETF by submitting Form S-1 to the US SEC today, October 2, 2024. Looking at the timing of incorporation, it appears that Canary Capital was the first to file for XRP ETF, according to the Delaware Division of Corporations website.

Despite the positive development, XRP is still struggling to gain momentum due to the ongoing conflict between Iran and Israel.

XRP Current Price Momentum

At press time, XRP is trading near $0.588 and has experienced a price decline of over 4.5% in the last 24 hours. During the same period, its trading volume jumped by 65%, indicating a notable surge in the participation by traders and investors amid price decline.

XRP Technical Analysis and Upcoming

According to expert technical analysis, XRP appears bearish and experience a price decline in the coming days. However, it is currently trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

Based on the historical price momentum, if XRP closes its daily candle below the $0.568 level, there is a strong possibility that it could face a price decline of over 10% in the coming days.

On-Chain Metrics

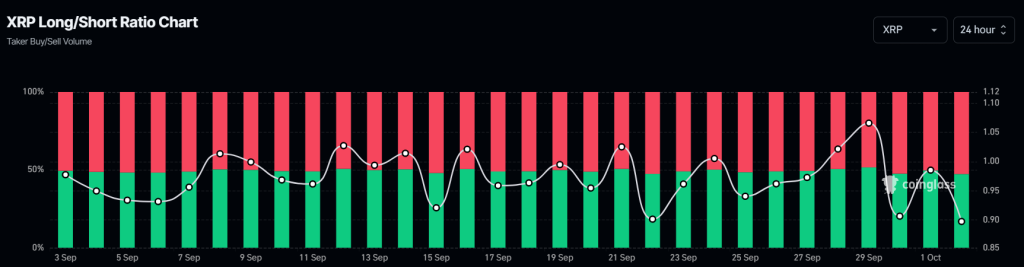

Besides the technical analysis, XRP’s on-chain metrics are flashing a bearish signal. According to the on-chain analytics firm Coinglass, XRP’s Long/short ratio currently stands at 0.897, indicating a strong bearish sentiment among traders.

Additionally, its future open interest has declined by 15%, indicating liquidation of traders’ positions, and it is hesitating to build new ones.

Credit: Source link