Glassnode data analyzed by CryptoSlate revealed that Binance accumulated 3.8 billion USD Coin (USDC) during the past three weeks.

Binance’s USDC pool sits at 5.1 billion coins at the time of writing, marking a 292% increase over the past three weeks.

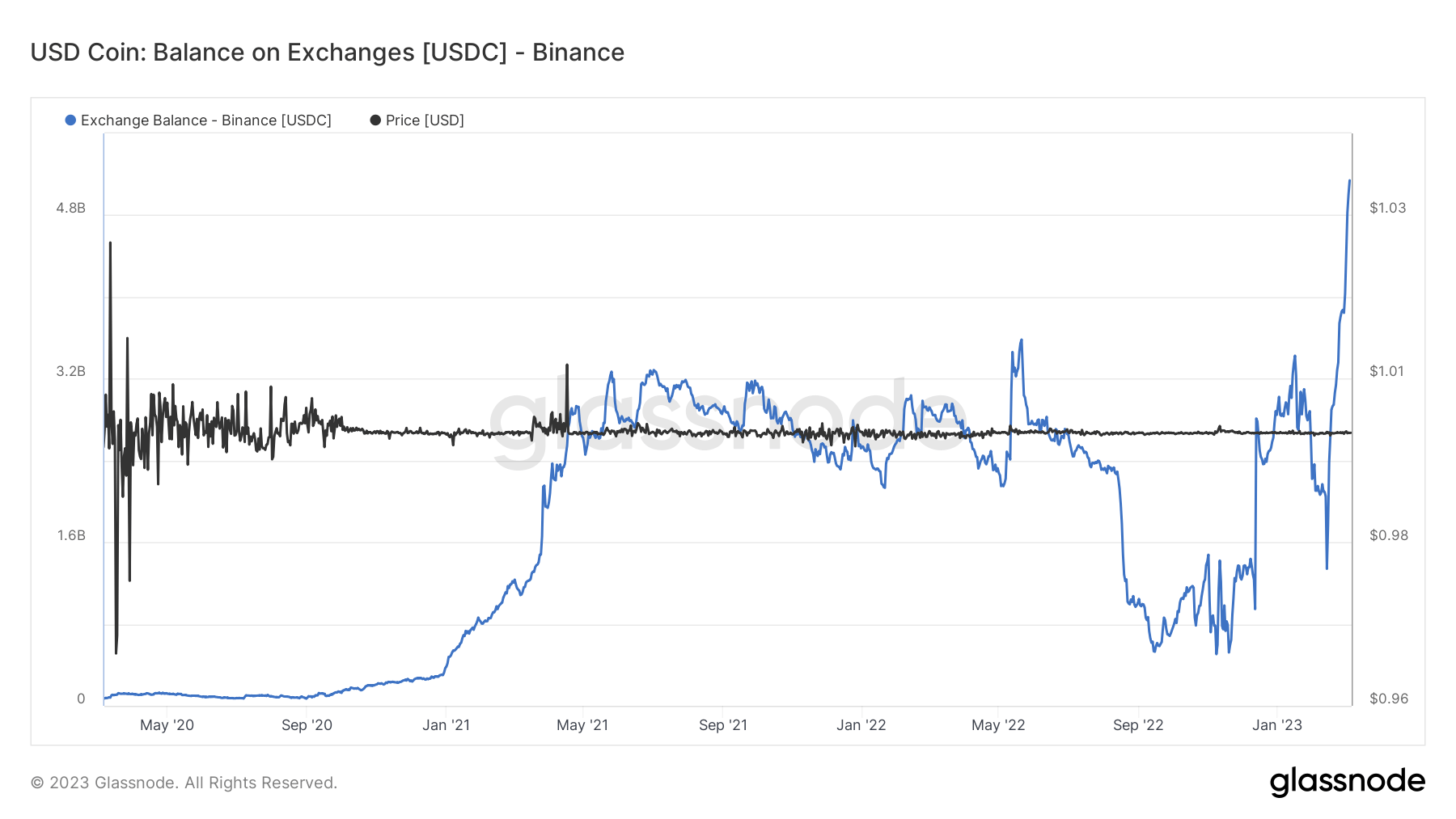

USDC balance on Binance

The chart below represents the USDC balance held on the Binance exchange with the blue line since the beginning of 2020. According to the data, Binance started buying in February 2021 and accumulated a little over 2.4 billion USDC.

Binance maintained its USDC levels until very recently, except for a short period from September 2022 to January 2023, when the USDC reserves fell to below 800 million.

The chart demonstrates that the exchange’s USDC reserves recorded a spike increase during the last three weeks. During this period, the USDC balance of the exchange increased from 1.3 billion to 5.1 billion, marking a 292% increase.

Binance held only 500 million USDC in September 2022, which indicates that the current levels reflect a 920% increase from the September levels.

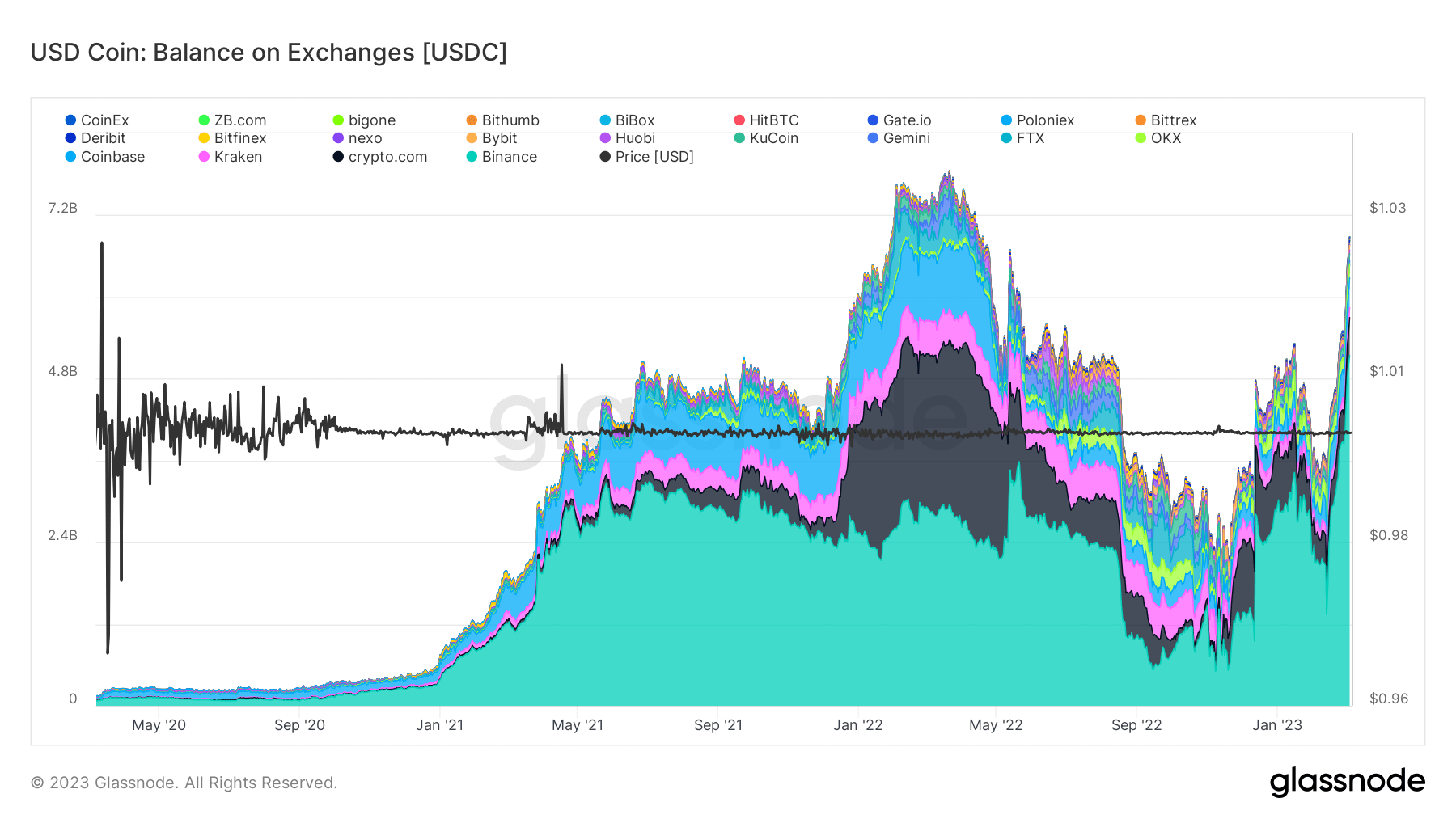

USDC balance on exchanges

Binance’s recent actions are also visible on the chart below, which demonstrates the amount of USDC held by exchanges. The turquoise area represents Binance’s USDC holdings, which marks the recent 292% increase.

The chart above also reflects the USDC amounts each exchange holds. By visual comparison, it can be seen that Binance has been holding the largest USDC pool since January 2021.

Why USDC?

Binance’s Binance USD (BUSD) reserves shrunk considerably at the end of February after the Securities and Exchange Commission (SEC) issued a notice to halt BUSD minting on Feb. 13.

Binance’s CEO Changpeng Zhao (CZ) noted the change on Feb. 17 and said the stablecoin landscape has been changing to be dominated by Tether (USDT). CZ stated:

“BUSD market cap dropped -$2.45B (from 16.1B to 13.7B as of now), and most of it has moved to USDT.

USDT marketcap + 2.37B (From 67.8B to 70.1B)

USDC also declined -739M (from 42.3B to 41.5B)

Landscape is shifting.”

He was proven right. According to a CryptoSlate analysis from Mar. 3, USDT’s dominance over the stablecoin market exceeded 55%.

Credit: Source link